- Have any question?

- (043) 406-2911

- marketing@olcmc.com.ph

What Is a Broker? Definition, Examples and How to Find One

Practique el intercambio de parejas asi como estuve en orgias por mi ex

June 5, 2023Must i Qualify for financing which have Option Earnings?

June 5, 2023What Is a Broker? Definition, Examples and How to Find One

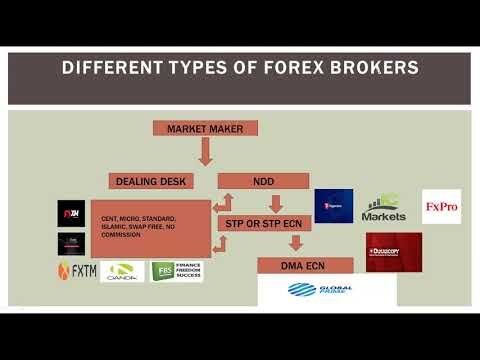

The sales management approach, however, can vary depending on the industry they are operating in. Certain industries require sales approaches that focus on increasing the quantity of sales, while others concentrate on generating revenue through high-value accounts. Each type of sales involves slightly different sales management skills so it is crucial to identify the niche that suits you best. Although most brokers work on behalf of sellers, some of them represent the buyer. However, they can never represent both the buyer and seller at the same time. Brokers also sell trades to market makers, which earns them a small fee per trade.

- A few states even permit the same broker to represent both the buyer and the seller in a transaction.

- Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues.

- Special additional benefits received because of an employment position.

- Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market at a price reflecting its intrinsic value.

- In the UK, it is generally only business brokers specialised in the sale of accountancy practices who operate as transaction brokers.

Pawnbrokers offer loans to people who offer items of personal property as collateral. They typically accept jewelry, computers, video game systems, and other possessions as collateral. Insurance brokers or insurance agents sell, solicit, or negotiate insurance for compensation. This type of broker works on behalf of companies that are looking to borrow money.

Most discount brokerages now offer their customers zero-commission stock trading. The companies make up for this loss of revenue from other sources, including payments from the exchanges for large quantities of orders and trading fees for other products like mutual funds and bonds. A brokerage firm or brokerage company is a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments. For example, licensed real estate brokers may advertise properties for sale and show them to prospective purchasers.

Examples of broker

A broker talks to the buyer and seller to wind up a productive negotiating discussion. Cooper notes that his own business practices have changed over the last forty years and will continue to do so. Raincatcher will operate as your trusted advisor throughout the entire sale process, so you can sell your business at an attractive price without regrets.

Special additional benefits received because of an employment position. In closely-held businesses these are often a result of the business’ ability to pay for them, more than a result of market rate compensation for the services provided to the business. Perquisites are commonly referred to as “perks.” Perks include items such as company paid vehicles, insurance, travel, memberships, salary in excess of market rate, bonuses, etc.

- Brokers start by understanding the seller’s motivations, and potential obstacles to a sale.

- Investors have historically paid a broker a commission to buy or sell a stock.

- The principal value of a business broker is to act as a buffer

between the buyer and the seller. - Sales management also involves analyzing sales data to identify trends and areas for improvement, as well as collaborating with other departments to ensure a positive customer experience.

- Most of these intermediaries sell small businesses worth less than $1 million in value.

It contains information about the business, including its products, markets, competition, and financial performance. The CBR is provided only to qualified buyers who have signed non-disclosure agreements. An agreement between two or more business brokers or brokerage firms for sharing the responsibilitities for and the fees from the completion of a transaction. A business broker is an individual or company that assists in the purchase and sale of small, main street businesses. By directly impacting revenue generation, it is critical to a business’s growth and sustainability. As a sales manager, it is imperative that you set high, yet realistic goals.

De jure means Existing in law, or having formal, legitimate, moral, or rightful effect, force, or possession. The current cost of a similar new asset or property having the nearest equivalent utility to the asset or property being valued. Financing an outside manager or management team to acquire a target company.

Licensing of Business Brokers

In some states, brokers can choose to act as transaction brokers, representing neither party as an agent but working to facilitate the transaction. In this situation, there is no fiduciary duty created and the broker deals with both parties on the same level. Telemarketing means contacting people – usually by phone – in order to sell a product or service, gather information, or persuade people to do something. The identification of the type of value being used in a specific engagement (e.g., fair market value, fair value, investment value).

Digital Asset Brokers: Proceed with Caution – Publications – Morgan Lewis

Digital Asset Brokers: Proceed with Caution – Publications.

Posted: Wed, 28 Dec 2022 08:00:00 GMT [source]

Typically, stock trades are computerized whereas something like real estate requires a more personal touch. A broker is an individual or firm that acts as an intermediary between an investor and a securities exchange. Because securities exchanges only accept orders from individuals or firms who are members of that exchange, individual traders and investors need the services of exchange members.

Training and Qualifications to Become a Business Broker

It can also be the ratio of selling price to DE for a small business. Most often, however, a multiple is a generated value as an outgrowth of the valuation of a business. An accounting method of valuing inventory, based on the assumption that the “last”, most recent, unit of an item of inventory purchased is the first unit sold out of inventory. In pricing the inventory under this valuation method the ending inventory is the aggregate of the cost of the oldest units of each item, purchased within the accounting period.

Any other broker may also enter into a similar non-exclusive agreement with the seller. The broker who brings in the winning buyer for the property collects a commission. The value, as of a specified date, of future cash inflows less all cash outflows (including the cost of investment) calculated using an appropriate discount rate. NPV is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. They represent both retail and institutional clients either through a stock exchange or over the counter.

They also know how to market a company for sale and often will be able to identify serious buyers with sufficient financial resources from those who are just bluffing. Software as a Service (SaaS) companies sell software or applications online typically on a subscription basis. The sales process is often remote with deals being finalized through email or the phone. A sales manager overseeing an SaaS team typically employs a results-oriented management style that focuses on achieving sales targets and maximizing revenue growth.

Small Business Administration (SBA)

An example of this would be if a high-net-worth investor named Amy wanted to place a large buy order for Tesla Inc. (TSLA) stock. Amy would call or message her broker, telling business broker definition them to execute the buy order of, say, 10,000 shares. This is an order in the millions of dollars so Amy feels more comfortable having a broker execute the trade directly.

Even though the intermediary represents the seller in a transaction, once a buyer and seller agree to an offer, often the broker will spend most of their time with the buyer to complete the transaction. The broker’s success fee is usually paid by the seller once a business sells and is based on a percentage of the selling price of the business. A business broker is an intermediary who assists clients in buying or selling businesses. Executing company purchases and sales https://trading-market.org/ is a complex undertaking that can cause many headaches and sleepless nights. Business brokers have specialized knowledge of the tax and legal implications involved in these transactions, helping to save on costs and reduce the risk of potentially crippling issues surfacing later on down the line. Brokers’ fees generally range anywhere from 5 to 10 percent of

the selling price of the business, depending on negotiations with

the broker, state laws and other factors.

Legal Alert Commercial Financing Disclosure and Broker … – Husch Blackwell

Legal Alert Commercial Financing Disclosure and Broker ….

Posted: Wed, 18 Jan 2023 08:00:00 GMT [source]

Instant messaging apps such as Slack, Microsoft Teams or Google Chat enable managers to instantly communicate with team members, even when they are on the go. Team members can download the apps onto their mobile device or their laptops. The apps provide various features such as direct messaging, group conversations, file sharing and video meetings to help sales managers effectively communicate with their team. To take training a step further, it is a good idea for sales managers to allow new salespeople to shadow a highly effective team member for the first weeks on the job.

The suitability standard requires the broker to recommend actions that are suitable to your personal and financial circumstances. The higher fiduciary standard requires the broker to act in your best interests. The same names pop up for mobile brokerage apps, along with newer competitors such as Robinhood and Acorns. You may have to pass Series 7 and either the Series 66 or Series 63 exams. In fact, virtually every citizen in the advanced economies can afford to invest in the stock market today. Your business is unique, and you need an expert who can communicate why your firm is uniquely valuable.

Examples of unplanned exits include death, divorce, management disputes, influx of competition, technological obsolescence, loss of a major customer, or other unforeseen economic events. That amount of anticipated economic benefits that exceeds an appropriate rate of return on the value of a selected asset base (often net tangible assets) used to generate those anticipated economic benefits. Earnings of a business prior to interest expense or income, and prior to corporate income taxes paid. This definition recognizes interest as a cost of capital, and not as an operating expense. Often includes a detailed review of accounting history and practices, operating practices, customer and supplier references, management references and market reviews.

However, many are switching to a wrap-fee business model in which all services, including stock trades, are covered by an all-inclusive annual fee. Business brokers receive commissions based on a percentage of the sale price they secure for the business, typically 10%-15%. Businesses who are looking to sell can locate with business brokers through accountants, professional associations, attorneys, and the International Business Brokers Association. Investment bankers may also provide other services to their clients such as mergers and acquisitions advice or advice on specific transactions, such as spinoff or reorganization. In smaller organizations that do not have a specific investment banking arm, corporate finance staff may fulfill the duties of investment bankers. Investment bankers require specific skills – number crunching ability, excellent verbal and written communication skills and the capacity to work for very long and grueling hours.

They don’t have to own the property, but they do need to be running a business out of the same premises they live in for the business to be considered a home business. The degree of uncertainty of realizing expected future returns of the business resulting from financial leverage. In a family succession or retirement transition, ownership transfers from current owners to other family members.